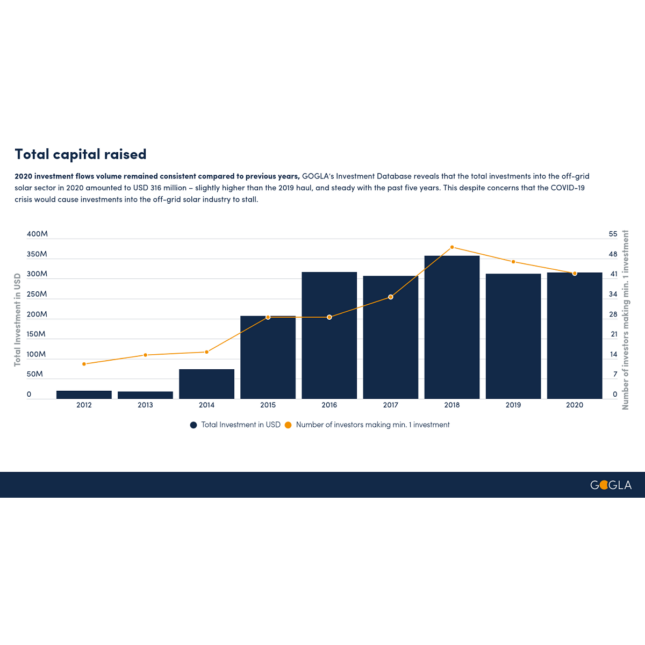

16 June 2022| GOGLA, the global association for the off-grid solar industry, supported by GET.invest, has recently updated its Investment Database, showing a 44% growth in 2021, with the total investment reaching a record $450M within the year. This is a positive sign after a trend of stable investment flow over the past five years, indicating a new period of growth that should push the industry towards achieving universal energy access by 2030.

Profitable established companies are unlocking large-scale climate finance

Market leaders in the sector are gaining new investors’ trust as they reach profitability by diversifying into energy-adjacent products such as mobile phones and digital finance, driven by consumer demand. This shows that the infrastructure built by off-grid solar companies has a great potential to be maximized to respond to new consumer needs.

Climate-aligned and impact-driven investors have been particularly interested in entering the sector since off-grid solar aligns with their social, economic and environmental strategies. Although not part of the 2021 results, the $260M Sunking equity raise in 2022 is a good example of this.

Start-up companies need more equity and debt

Companies in the early stages of growth were more vulnerable to the negative impacts of the COVID-19 pandemic, which translated into an increased difficulty to attract early-stage capital, specifically equity.

In 2021, the total equity and debt investment into startup companies grew but it hasn’t yet reached pre-pandemic levels. Additionally, just to achieve SDG7 and climate goals in Africa, funding would still need to grow multiple times over, particularly in the form of patient equity.

Seed and start-up phase off-grid solar businesses have historically relied on grant financing to refine their business models and gain the proof points required by more commercially oriented equity and debt investors. In 2021, the sector attracted around $10M in grants, which were directed at earlier stage productive use companies and those that are locally-owned and managed.