Scaling up access to finance for women energy entrepreneurs

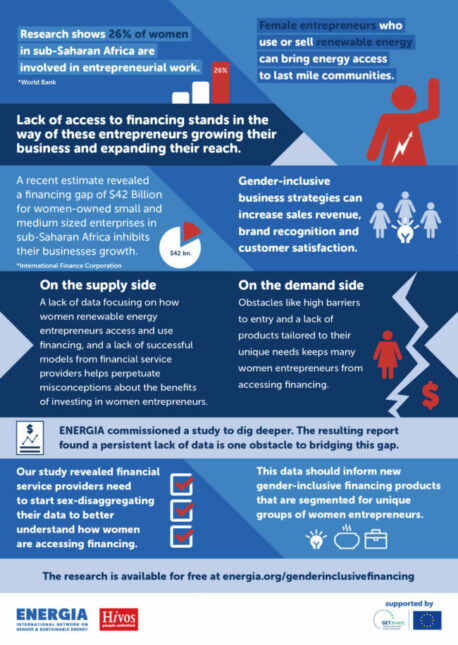

8 March 2023 | Women entrepreneurs in the renewable energy sector play a key role in driving energy access, in particular in the last mile. At the same time, they face many barriers in accessing finance, which limits the growth of their businesses. Recent estimates reveal that women-owned and led micro, small and medium enterprises (WMSMEs) have a combined financing gap of $50billion. In particular, one large obstacle stands in their way: investors, financiers and renewable energy companies on the supply chain lack data on these potential customer segments and their financing needs in order to provide suitable funding solutions.

Building the business case for women’s inclusive financing

To bridge this gap, GET.invest collaborated with ENERGIA – the International Network on Gender and Sustainable Energy – on a project gathering insights, lessons learned and strategies to guide financial service providers, investors and other stakeholders in developing more inclusive financing solutions.

A research report written in partnership with Distill Inclusion identified some of the main challenges on the supply and demand side when it comes to financing for WMSMEs. Two women entrepreneurs supported by the GET.invest Finance Catalyst contributed with their own experience:

In Sierra Leone, Freetown Waste Transformers turns organic waste into electricity and fertilizer. Led by CEO Aminata Dumbuya-Jarr, the company tried multiple avenues to land external investment for a pilot project, but had to use their own funds instead when facing roadblocks. “It was really challenging to get partners to come on board and put money”, Dumbaya says. “Women businesses are not given the priority when it comes to financing and are not taken seriously at times”. The success of their pilot led an impact investor to provide the funds needed to build four additional installations in Freetown.

Similarly, Lanforce Energy had to invest their own savings from other work streams to get off the ground, unable to find funders willing to invest seed money. The renewable energy company headed by Judith Marera constructs and installs biogas digesters for customers in rural Zimbabwe, in addition to selling appliances engineered to run on the energy created by the digester. Although it was difficult for the company to take off and grow, Lanforce Energy has since become successful, and the business now offers credit to customers to purchase systems.

To better meet the needs of these companies, financial service providers and investors need guidance on making their instruments and processes more inclusive. To this end, an online toolkit was developed. Aiming at advancing women’s entrepreneurship development, “Building the Business Case for Women’s Inclusive Financing in Last-Mile Renewable Energy Markets in Sub-Saharan Africa” outlines strategies, tools and resources to help financiers build a solid business case towards providing equitable offerings, including specific questions, case studies and exercises. Topics include leveraging sex disaggregated data, conducting customer research and segmentation for WMSMEs, and providing gender-integrated business technical support.

In three closed-door roundtables, lessons learned from the project were shared and discussed with donors, investors, financial service providers and renewable energy companies.

GET.invest’s support to WMSMEs

The collaboration with ENERGIA aligns with GET.invest’s broader goal to support the growth and finance access of women-owned or led companies in the renewable energy sector.

Through the GET.invest Finance Readiness Support, GET.invest offers a combination of business development support and advice on access to finance to enhance company structures and processes for raising capital to locally owned and managed companies. Currently, over 75% of the companies in the portfolio are women-owned or led companies. This offer complements the work of the GET.invest Finance Catalyst, which deals with more mature businesses and links them with financiers. The team provides advisory support in the areas of investment strategy, business case structuring and accessing finance, aiming to reach financial close.

Learn about women entrepreneurs we have supported and the impact of their journeys in our GET.invest stories.