The end of onions powered by diesel engines in Senegal

Key figures

Expected results

The end of onions powered by diesel engines in Senegal

About

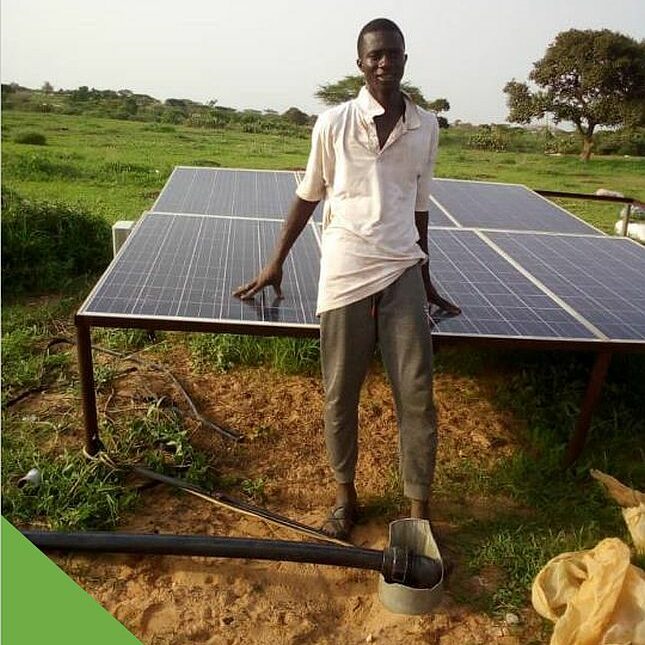

In 1999, farmers in Potou, in the key agricultural area of Niayes in Senegal, founded a microfinance company called Mutuelle d’Epargne et de Crédit de la zone de Potou (MECZOP) with the support of a Belgian NGO. MECZOP remains a provider of small loans that particularly help onion producers, who are very active in the region and depend on irrigation systems at different scales for their crops. Irrigation means onion farms are never far from the roar of diesel pumps bringing water to their fields. But recently, MECZOP found a very promising combination of irrigation and solar energy to help farmers stop relying on diesel and continue growing onions.

MECZOP has a long history of providing microcredits to farmers who need to purchase inputs such as seeds and fertilizer. In recent years, it has made a leap forward by helping its members gradually get rid of their most expensive factor of production: generator fuel. Loans for solar irrigation allow farmers to replace costly and polluting diesel through a traditional microfinance operation. The money they save on fuel allows them to repay their loans faster, and after two or three years, the solar pumps are theirs.

Beyond individual farmers, MECZOP now includes farmer groups and management committees for larger water systems with higher electricity needs. This is a complex new renewable energy market, made up of many small operators. But with its extensive, decades-long market experience and established relationships with local farmers and their groups, MEZCOP is in an excellent position to offer solar loans with minimal additional risk or paperwork.

Our support

MECZOP joined the GET.invest Finance Catalyst thanks to the Green People’s Energy for Africa initiative in Senegal. This initiative was launched by the German Federal Ministry for Economic Cooperation and Development and implemented in part by the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) and the KFW Development Bank. It provides renewable energy companies with technical assistance and small grants, but MECZOP needed a higher level of financing to meet the rapid growth in demand for solar loans. MECZOP had few options for raising funds in Senegal, and did not have the experience or network to go beyond. Through GIZ, Green People’s Energy therefore helped MECZOP to apply for the GET.invest Finance Catalyst.

While supporting a microlender was a new direction for Finance Catalyst, GET.invest saw the potential of a locally developed and adapted model, ready to take off, and decided, with MECZOP, to aim high. Finance Catalyst’s advisor first collaborated on developing a revised presentation that showed how MECZOP’s strategy allows each party to do what they do best: for farmers to cultivate, for their committees to manage irrigation, local solar equipment sellers to set up systems, and MECZOP to manage financing. The advisor also developed a financial model showing how it would work on a large scale.

The biggest contribution was identifying the right financier, which turned out to be Swiss company iGravity , a consultancy that manages several development impact investment funds. One of the funds managed is the Swiss HEKS/EPER Foundation Investment Portfolio, which provides debt financing and support to businesses, primarily in Uganda and Senegal, to help them scale their impact, particularly in rural areas. It was an excellent choice for MECZOP.

To help a small Senegalese lender make a good impression with this international fund manager, the GET.invest Finance Catalyst contacted MECZOP and supported them throughout the due diligence process. The Finance Catalyst advisor also accompanied the iGravity team on a visit to MECZOP and the Potou onion farms in 2022, thus integrating an independent expert into the due diligence process.

Result

Following the evaluation of the project, MECZOP received a loan of €300,000 from iGravity . The microlender quickly finances other solar pumps with this capital, adapted to three sizes of borrowers. Individual farmers can borrow for pump installations suitable for a small farm, while groups coming together to irrigate more land together can invest in a medium-sized solar installation to irrigate a larger combined area. Management committees that manage government-built irrigation systems — the largest systems, with water towers — can take out the largest loans to deploy enough solar power to run those systems. Committees are often preferred borrowers due to their track record and the diversification of risks among multiple members. By eliminating fuel costs and emissions, committees can also use future savings to improve services and reduce tariffs, meaning farmers can spend more of their own money on other inputs and other improvements.

From a broader perspective, the relationship that the GET.invest Finance Catalyst has established between Potou and Zurich also has important demonstrative value. It is not often that a small local microfinance institution like MECZOP is able to raise debt capital from an international fund. This is a notable achievement for other local lenders and businesses who are determined to access the same opportunities as foreign companies doing business in Africa.

Disclaimer: This story was last updated in December 2023.